Read Time: 3 minutes

There is increasing debate around the high volumes in options segment, with many concerned that such high volumes may bring in market turmoil, but we believe that the rise in volumes will help ensure better price discovery which in turn will lead to price stability.

The daily volume in stock market is INR 75,000 crore notional approx. and corresponding notional volume in options market is INR1,00,00,000 crore. The 100x plus multiple volume (400x on certain days), has led a few to wonder if this increases systemic risk; but such concerns have been vaguely raised without understanding both (A) how margin money in options market keep systemic risk fairly low, and (B) the buildup of volumes in weekly segment together with most of it being in index options again ensuring systemic risk is almost absent.

The options market works on the principle of margins. This means if one wants to sell options worth say INR 1,00,000 notional, the individual will have to park around 15% (the number could be higher or lower depending on the variation in daily moves of the underlying) of it with the exchange as margin. Now, if that position starts making a loss, the option player will be asked to fill up the loss at market close, failing which the position will be liquidated by the exchange.

The 15% margin is so high that index level positions get easily covered. Nifty, Bank Nifty and Financial Services index, the 3 indices presently available for options trading, do not move by 15% in a single day! (most move in a much more modest way) Therefore, margin money helps to ensure adequate risk mitigation

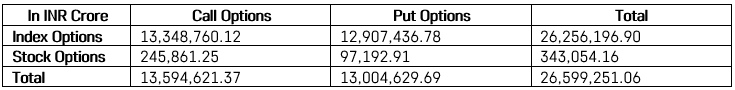

The other interesting piece is that 95% of the volume in the options segment is in index options! The following table shows volume break-up as on August 22, 2023, and what becomes very clear is that the stock options are a tiny part of total options market.

As illustrated above, less than 5% of the total options volume occurs in stock options but at INR 2,50,000 crore that is also a significant number. The good thing though is that most of these stock options happen in select large caps, where price discovery is high. In addition, margins for stock options is higher than Index options; stock options margin could be 20% approx. against 15% for Index options, so the scope for a large move is wider here, But a complimentary point is that most large caps, like Index, seldom see a 10% move. Hence, even at stock level, the risk of contagion is limited as big moves in large caps rarely happen.

Another important point is that Index options can be further sub-categorized into weekly options and monthly options. Stock options are only monthly options, they do not have any weekly options. The point to note is that 90% of index options are in weekly options, with monthly index options accounting for the remaining 10%. This ensures that 90% of Index level positions get squared and cleared on a weekly basis and that further mitigates risk.

In conclusion, options volume provide investors with hedging instruments and the presence of a margin money lowers risk as an overwhelming majority of positions being in weekly index options additionally guarantee that majority positions get flushed on a weekly basis. Rather than adding risk, the growth in the options market has ensured price discovery at its best!

(The article was first published by The Economic Times)